Since 2014 under Affordable Care Act rules, new ACA qualified health plans had just one rate for dependents from ages 0 to 20. In 2018 there will now be 7 different age based rates with the first for ages 0 – 14. Beginning at age 15 there will be a separate age rates per year up to age 20. The new member level age rating does not apply to grandfathered plans.

Anthem adjusts Individual health plan offerings in California for 2018

Next year, we will offer plans in three regions of Northern California only, which will include Redding, Santa Clara County, and Stockton/Modesto. The coverage options will include EPO plans available both on-exchange and off-exchange, and at all metal levels. Staying in these three key areas will help ensure Californians in those regions have access to health plans.

Blue Shield $5 Teladoc Consultations for 2017

Blue Shield of California will make Teladoc consultations a $5 copayment for members of their individual and family plans. The $5 Teladoc consultation will be available to both Blue Shield’s HMO and PPO non-grandfathered plans in 2017.

Cigna files for 18% increase in California individual and family plan rates

Cigna has filed their 2017 California individual and family plan rates with the California Department of Insurance requesting overall rate increase of 18%. Cigna’s rate filing states the new 2017 health insurance premiums would affect 18,253 of their members in California.

Health Net requests 23% rate increase for 2017 California individual and family plans

The California Department of Insurance (CDI) has posted the health insurance premium rate increase requests by Health Net for their 2017 California individual and family plans. The overall increase request is 23%, with a maximum for some health plans as high as 34%. The Health Net rate increase would apply to 11,582 members currently in their PPO and EPO health plans.

How Your Income Affects Your Premium Tax Credit

You are allowed a premium tax credit only for health insurance coverage you purchase through the Marketplace for yourself or other members of your tax family. However, to be eligible for the premium tax credit, your household income must be at least 100, but no more than 400 percent of the federal poverty line for your family size. An individual who meets these income requirements must also meet other eligibility criteria.

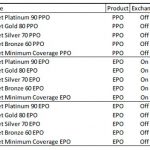

Anthem Blue Cross California releases 2016 individual and family plan material

The exclusive provider organization (EPO) is now a tiered preferred provider organization (PPO) plan. Members on 2015 EPO plans will be transitioned to Tiered PPO plans effective 1/1/16 (unless they choose a different plan).