We are notifying the members in the following closed plans that their prescription drug coverage will be considered non-creditable in 2017, which is a change from 2016, when their prescription drug coverage was considered creditable. This means that the coverage offered by their plan is not expected to pay out as much as standard Medicare prescription drug coverage pays.

Anthem Blue Cross Makes Changes to Acupuncture Review and Claims Process

Starting October 1, 2016, American Specialty Health (ASH) will process all acupuncture claims, in and out of the network, for our California fully insured large and small group PPO (Preferred Provider Organization) plans. ASH also will review claims for acupuncture care to make sure the services members get are medically necessary.

Commissioner Jones supports DOJ block of health plan mergers

I’m very pleased with the U.S. Department of Justice action today to block these mergers because they are anti-competitive and would harm consumers and businesses. As insurance commissioner of the largest insurance market in the country, I urged the DOJ to prevent both of these health insurance mergers, which if approved would have resulted in a highly concentrated, less competitive health insurance market doing irreparable harm to consumers and businesses.

Cigna files for 18% increase in California individual and family plan rates

Cigna has filed their 2017 California individual and family plan rates with the California Department of Insurance requesting overall rate increase of 18%. Cigna’s rate filing states the new 2017 health insurance premiums would affect 18,253 of their members in California.

Health Net requests 23% rate increase for 2017 California individual and family plans

The California Department of Insurance (CDI) has posted the health insurance premium rate increase requests by Health Net for their 2017 California individual and family plans. The overall increase request is 23%, with a maximum for some health plans as high as 34%. The Health Net rate increase would apply to 11,582 members currently in their PPO and EPO health plans.

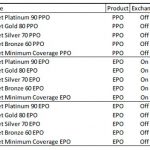

Health Net requests 15% rate increase for California small group plans

Health Net has filed new small group health insurance premium rates for 2017 with the California Department of Insurance. In the filed rates, Health Net is proposing an average expected annual increase of 15% to their PPO and EPO plans.

Family caregivers urged to explore insurance options and resources

Caregivers may want to consider obtaining a life insurance policy to help provide support to others in case something happens to them. Another consideration is disability income insurance, which offers protection by replacing a percentage of one’s previous income if they are unable to work due to a disability. If a caregiver plans to leave a job to be a full-time caregiver, they need to ensure they will have access to healthcare.

California agency approves Aetna’s purchase of Humana

California Department of Managed Health Care (DMHC) Director Shelley Rouillard has approved Aetna’s acquisition of Humana.

Commissioner Jones urges blocking Anthem Cigna merger

California Insurance Commissioner Dave Jones today urged the U.S. Department of Justice to block the merger deal between Anthem, Inc., and Cigna Corporation. After an extensive review of the Anthem and Cigna merger, Commissioner Jones issued detailed findings that the merger of the second and fourth largest national health insurers is anti-competitive and will harm California consumers, businesses, and the California health insurance market.

UnitedHealthcare files for small group rate decreases

UnitedHealthcare has filed for a small group rate decrease with the California Department of Insurance. The new rates would be effective October 1, 2016. The new UnitedHealthcare rates are for the Select, Select Plus, Core, and Non-Differential insurance plan products.

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- 8

- Next Page »