Oscar, a new health plan carrier to California, is slowly trickling out information on their individual and family plans for 2016. All of Oscars plans will be EPOs offered in parts of southwest Los Angeles County and all of Orange County.

Covered California mails out renewal notices for 2016 health insurance

Covered California sent notices to consumers who are enrolled or pending in a Covered California Health Plan in 2015 to renew for coverage in 2016. These notices explain the renewal process and the importance of retaining health insurance to consumers. Below, find the important information you need to know.

Kaiser releases 2016 California health plan material

In California Kaiser Permanente will be offering ten different health plans for 2016. Six of the plans are the standard benefit design that will be offered through the Covered California Marketplace. Four of the plans are of a non-standard benefit design and will only be available off-exchange directly from Kaiser.

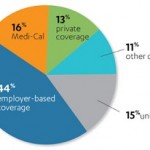

Covered California releases demographic and enrollment data

Covered California also released data on the ethnicity of its enrollment population, which illustrates the positive enrollment trends seen over the last 18 months. While Covered California is increasingly improving its enrollment to better reflect the diversity of subsidy-eligible Californians, this improvement will take time to be fully reflected in active membership, which accounts for all the consumers enrolled since January 2014.

Blue Shield approved to acquire Care 1st Medi-Cal provider

California Department of Managed Health Care (DMHC) Director Shelley Rouillard has issued an order approving Blue Shield of California’s (Blue Shield) acquisition of Care1st Health Plan (Care 1st). “This order brings Blue Shield into the Medi-Cal program and requires the plan to improve quality and access for Medi-Cal beneficiaries. Prior to approval, my team performed an exhaustive review of all aspects of the proposed transaction, performed complex legal analyses, conferred with external experts and considered all public comments,” said Director Rouillard.

How Your Income Affects Your Premium Tax Credit

You are allowed a premium tax credit only for health insurance coverage you purchase through the Marketplace for yourself or other members of your tax family. However, to be eligible for the premium tax credit, your household income must be at least 100, but no more than 400 percent of the federal poverty line for your family size. An individual who meets these income requirements must also meet other eligibility criteria.

Health Net closing some California PPO plans for 2016

Health Net of California, Inc. and Health Net Life Insurance Company (Health Net) will offer a simplified line-up of IFP products for 2016. There are differences in the plans we offer through Covered California and those available direct from Health Net. As such, the changes and what members have to do, if anything, depend on how they enrolled.

Blue Shield enrolls final member group in Cal Index

Blue Shield will notify a final group of subscribers in mid-October 2015 of Cal INDEX enrollment. This final group of subscribers enrolled before a more streamlined process was created earlier this year. Through the end of 2015, new Blue Shield subscribers will be notified via the online welcome process or via a buck slip in their welcome letter of their enrollment in Cal INDEX. Beginning in 2016, the notification will be incorporated into all Evidence of Coverage documents.

Blue Shield to drop Stanford Health Care from IFP network

As part of our continuing efforts to help make access to health care more affordable for our members, Blue Shield of California is removing Stanford Health Care from our Individual and Family Plan (IFP) Exclusive PPO Network, effective January 1, 2016. Stanford Health Care remains a provider for all of our other plans outside of the IFP Exclusive PPO Network.

What’s driving small group rates up

Anthem Blue Cross of California has released an infographic summarizing the factors which cause a grandmothered or legacy small group to realize a higher than expected increase in rates. In 2016 all small group plans must become ACA compliant. This means they must include certain new medical elements, but how the rates are determined are also affected.

- « Previous Page

- 1

- …

- 27

- 28

- 29

- 30

- 31

- …

- 38

- Next Page »