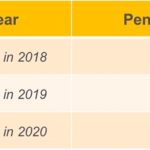

The penalty also remains in effect for 2018 coverage. The only change is the tax penalty will no longer be in effect beginning in 2019.

IRS Extends Due Date for Employers and Providers to Issue Health Coverage Forms to Individuals in 2018

Insurers, self-insuring employers, other coverage providers, and applicable large employers now have until March 2, 2018, to provide Forms 1095-B or 1095-C to individuals, which is a 30-day extension from the original due date of Jan. 31.

Covered California Loss of Subsidy Because Of No Tax Filing

Beginning April, 24 2017, Covered California will send notices to consumers to notify them they are at risk of losing their Advance Premium Tax Credit (APTC) and/or cost-sharing reductions for health insurance coverage through Covered California in 2017.

Covered California Individual Shared Responsibility FAQ

The ACA requires everyone have Minimum Essential Coverage to comply with the law and avoid a Shared Responsibility Payment (also known as tax penalty, fee, or Individual Mandate payment). If a consumer 1) does not qualify for an exemption and 2) fails to have Minimum Essential Coverage, they will have a Shared Responsibility Payment due at tax time for the months the consumer did not have coverage or an exemption.

Countable Sources of Income from Covered California

Covered California has released a table of sources of income and whether they are countable toward the Modified Adjusted Gross Income (MAGI) for the monthly health insurance subsidy. The foundation for the table is the federal 1040 income tax return. The Countable Sources of Income table includes income for the monthly subsidy and whether the income is considered for MAGI Medi-Cal.

IRS.gov and Social Media Resources Help Individual Taxpayers Understand ACA

The IRS knows that you want to understand how the health care law may affect you when filing your taxes next year. When questions come up, IRS.gov/aca is a great place for you to begin finding the answers you need – when you need them.

Premium Tax Credit letter from the IRS

Some taxpayers will be receiving an IRS letter about the premium tax credit; this letter is also known as a 12C letter. Be sure to read your letter carefully and respond timely. Here are answers to questions you may have about this letter.

1095-B Form for the IRS and tax return

Form 1095-B, Health Coverage, is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore aren’t liable for the individual shared responsibility payment.

IRS facts on letters regarding 1095-A and tax returns

The IRS sent letters to taxpayers this summer who were issued a Form 1095-A, Health Insurance Marketplace Statement, showing that advance payments of the premium tax credit were paid on the taxpayer’s behalf in 2014. At the time, the IRS had no record that the taxpayer filed a 2014 tax return.

Covered California mails consent notification for 2016

Consent for Verification August 25, 2015 On August 14, Covered CA sent letters to members who currently receive subsidies. The letter advised them that they must give their consent for Covered CA to verify their income and family size to determine their subsidy eligibility for their health plan in 2016. IMPORTANT: Authorizing Electronic Consent to […]