Any beneficiary who resides in, or resided in, an area for which the Federal Emergency Management Agency (FEMA) has declared an emergency or major disaster (see www.fema.gov/disasters or the list below*) is eligible for the SEP, if the beneficiary was unable to enroll in a plan during another qualifying election period. In addition, beneficiaries who do not live in the impacted areas but receive assistance from someone living in one of the affected areas also qualify for this SEP.

Healthcare.gov Special Enrollment Verification Phase II: Marriage, Adoption, Medicaid

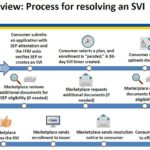

After a consumer has submitted an application under the Special Enrollment Period with a qualifying event, and then selects a health plan, the consumer will have 30 days to verify the qualifying event. The consumer can upload or mail the documentation verifying the qualifying event. The Marketplace will review the documentation and request additional information if necessary.

Reporting self-employment income to Covered California

Covered California has released guidance on reporting self-employment income. The 2016 Special Enrollment Quick Tips has not only income guidance for self-employed and season workers, but also information about qualifying events for the Special Enrollment Period outside of Open Enrollment and reconciling Advance Premium Tax Credits on the federal tax return.

Covered California Special Enrollment Instructions for 2016

Covered California has released instructions for navigating the Special Enrollment Periods consumers are eligible for when they have a qualifying event. It’s important that the online application be filled out a certain way for different qualifying events.

Some qualifying events eliminated for Special Enrollment Periods

Elimination of several unnecessary special enrollment periods, clarifies the definitions of other special enrollment periods, and provides stronger enforcement so that special enrollment periods serve the purpose for which they are intended and do not provide unintended loopholes.

Anthem Blue Cross drops SEP online applications

Anthem Blue Cross will accept only paper applications for special enrollment in individual plans sold off the exchange. Online applications for plans sold off the exchange during a special enrollment period (SEP) are no longer accepted.

Almost 1 million consumers use SEP to get health coverage in 2015

Between February 23 and June 30, 2015, about 944,000 new consumers made plan selections through HealthCare.gov using a SEP. Eighty-four percent of plan selections occurred via three types of SEPs: 50 percent of plan selections occurred via SEPs for the loss of health coverage or “minimum essential coverage”, 19 percent occurred via SEPs for being determined ineligible for Medicaid, and 15 percent were as a result of tax season SEP (Table 1). The remaining 16 percent of plan selections were attributable to other types of SEPs (see glossary).

Covered California continues to keep agents in the dark

The Covered California CalHEERS online enrollment system continues to be upgraded to fix problems and accommodate household changes, but Certified Insurance Agents (CIA) are rarely notified of the updates. As CIAs helped enroll 40% of Covered California’s households and continue to update their clients changes through the system, agents deserve to be provided regular updates […]