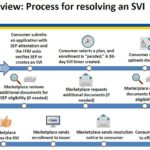

After a consumer has submitted an application under the Special Enrollment Period with a qualifying event, and then selects a health plan, the consumer will have 30 days to verify the qualifying event. The consumer can upload or mail the documentation verifying the qualifying event. The Marketplace will review the documentation and request additional information if necessary.

Special Enrollment Verification for Healthcare.gov Phase 1

Beginning on June 23, 2017, consumers applying for health insurance through the Federally Facilitated Market Place (FFM) of Healthcare.gov will have to provide documentation to verify the qualifying life events of loss of coverage or a permanent move. In August, consumers with a qualifying life event of marriage, becoming a dependent, or Medicaid denial will also have to provide verification.

Almost 1 million consumers use SEP to get health coverage in 2015

Between February 23 and June 30, 2015, about 944,000 new consumers made plan selections through HealthCare.gov using a SEP. Eighty-four percent of plan selections occurred via three types of SEPs: 50 percent of plan selections occurred via SEPs for the loss of health coverage or “minimum essential coverage”, 19 percent occurred via SEPs for being determined ineligible for Medicaid, and 15 percent were as a result of tax season SEP (Table 1). The remaining 16 percent of plan selections were attributable to other types of SEPs (see glossary).