Healthcare.gov Individual and Family

In August of 2017, individual and family plan markets run through Healthcare.gov will institute tighter verification requirements for Special Enrollment Periods triggered by the qualifying events of

- Marriage

- Gaining or becoming a dependent through adoption, placement for adoption, placement in foster care, or a child support or other court order

- Denial of Medicaid/Children’s Health Insurance Program (CHIP) denial

Consumers Must Verify SEP For Marriage, Adoption, Medicaid Denial

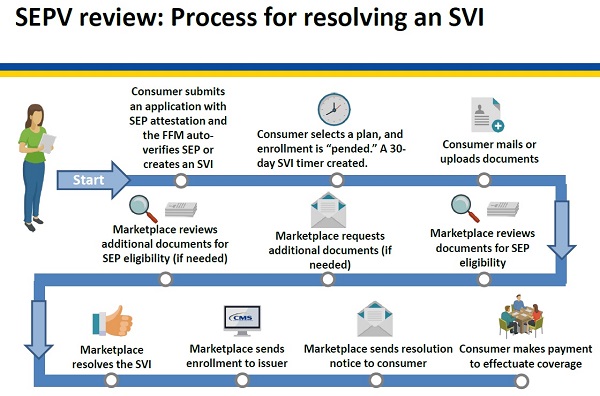

After a consumer has submitted an application under the Special Enrollment Period with a qualifying event, and then selects a health plan, the consumer will have 30 days to verify the qualifying event. The consumer can upload or mail the documentation verifying the qualifying event. The Marketplace will review the documentation and request additional information if necessary.

Once the Marketplace confirms or resolves the SEP Verification Issue (SVI), the enrollment is sent to the issuer. The consumer must ensure that they have made the first months binder payment to effectuate the coverage.

Flow chart of Special Enrollment Period Qualifying Event Verification Process and timeline.

A consumer may call the Marketplace Call Center within 30-days of getting their resolution notice to request a later coverage effective date that is no more than 1 month later if they would have to pay 2 or more months of retroactive premium to effectuate coverage.

Marriage SEP

In order to qualify for an SEP due to a marriage, at least one spouse must have:

- Had minimum essential coverage; OR

- Lived in a foreign country or in a U.S. territory for on or more days during the 60 days preceding the date of the marriage.

Consumers who qualify for an SEP due to a marriage must submit documents to confirm the marriage happened up to 60 days before they applied for Marketplace coverage.

To confirm eligibility for the marriage SEP, consumers should upload or mail documents to confirm who got married and the date of the marriage.

Adoption or Foster Care SEP

Consumers may qualify for an SEP if they gain or become a dependent due to:

- Adoption,

- Foster care placement, or

- Child support or other court order.

Consumers newly enrolling in Marketplace coverage through an SEP due to adoption, foster care placement, or a child support or other court order must confirm that their qualifying event occurred in the 60 days before they applied for Marketplace coverage.

To confirm eligibility for their SEP eligibility, consumers should upload or mail one or more documents signed by a government or court official, showing who was adopted, placed in foster care, or became a dependent due to a court order and the date of the qualifying event.

Denial of Medicaid

Consumers may be eligible for the denial of Medicaid/CHIP SEP if they apply for Marketplace coverage during an Open Enrollment Period (OEP) or within 60 days after another SEP qualifying event and are determined ineligible for Medicaid or CHIP by their state agency after OEP ends, or after more than 60 days have passed since their other SEP qualifying event.

Consumers may be eligible for this SEP if they applied directly through their state Medicaid or CHIP agency during an OEP and were denied after the OEP ended.

To qualify for this SEP, consumers must apply or re-apply for Marketplace coverage and choose a plan within 60 days of their Medicaid or CHIP denial.

Consumers who qualify for an SEP due to a denial of coverage through Medicaid or CHIP must return to their application or newly apply for coverage within the 60 days after their Medicaid or CHIP denial.

To confirm eligibility for the denial of coverage through Medicaid or CHIP SEP for those whose SEP cannot be verified electronically, consumers should upload or mail one or more documents on official letterhead that clearly identifies who was determined ineligible for Medicaid/CHIP coverage and the date they were determined ineligible.

For additional details, information, and resources, please download the CMS slide presentation on the SEP Phase II Verification Process.

https://calhealthnews.com/special-enrollment-verification-for-healthcare-gov-phase-1/

These new verification rules are specific to Federally Facilitated Marketplace exchanges Healthcare.gov and may not apply to state based exchanges such as Covered California.