Health Net

The California Department of Insurance (CDI) has posted the health insurance premium rate increase requests by Health Net for their 2017 California individual and family plans. The overall increase request is 23%, with a maximum for some health plans as high as 34%. The Health Net rate increase would apply to 11,582 members currently in their PPO and EPO health plans.

Update: Health Net to Discontinue 2016 PPO Plan Design. New PPO plans to be offered.

Health Net justifies 23% California rate increase

The main justifications by Health Net for the large increase in premiums in their initial rate filing are-

- Larger than expected substance abuse claims causing 2016 to be underpriced by 21.6%

- Sunset of reinsurance that represents $117 PMPM (per member per month) in claims for 2016

- Claims trend of 7.8%

Their rate filing noted in a subsequent submission to CDI, “As it stands, Health Net is expected to have an after-tax profit loss of -15% on risk adjusted premium due to losses on PPO. PPO premiums are inadequate to cover the anti-selective spiral seen on the PPO product off-exchange. We do not consider the premiums adequate to cover the risk at this time.”

Higher than expected substance abuse claims

Health Net’s rate filing went on to further discuss high substance abuse claims experience they had and how they were working to lower those costs.

(I) Claims without OON Substance Abuse Claims

This is 2015 claims cost without Out-of-Network substance abuse claims. Of these claims, roughly

(1) 20% is Inpatient Facility

(2) 50% is Outpatient Facility

(3) 30% is Toxicology Screens

We present this number in order to demonstrate the severity of Out-of-Network Substance Abuse claims on the single risk pool. Note the On-Exchange EPO product does not have Substance Abuse issues as it does not have OON benefits.

(J) OON Substance Abuse Cost Adjustment —-80% reduction

In CY 2015, Out-of-Network substance abuse claims consumed 42.7% of the dollars spend for this block of business. Prior to 2016, Out of network substance abuse claims were paid as a % of billed, because a Medicare Allowable rate was not available for this claim category. For example, toxicology was paid based upon CPT. There was no Medicare fee schedule amount. We now crosswalk services to G-codes because Medicare has allowed amounts at the G-code level.

We have fixed this coding pitfall, which will allow us to establish a reasonable reimbursement rate. This drop in reimbursement rate is expected to reduce OON substance abuse claims by 80%.

(K) Reduction in anti-selection exposure to substance abuse In CY 2015, we had an average of 660 (or 1.8%) substance abuse members during the year, culminating in a high of 1,149 (or 6.4%) members at December 2015. The number of claimants that incur OON substance abuse claims is expected to drop from that high of 1,149 as of December 2015 to an average of 528 (or 2.6%) of members.

While 2017 represents a reduction of 20% of CY 2015 substance abuse members, the portion of substance abuse members as a % of the total block is 2.6%, whereas the experience period had 1.8% of members as healthier members are more likely to lapse, increasing the impact of substance abuse members on the single risk pool’s projected claims. We have assessed this impact to add increase claims by 5.3%.

Unlimited maximum out-of-pocket for out-of-network expenses

Health Net originally requested that their PPO plans have no maximum cap on out-of-network out-of-pocket annual amount. This was changed in their subsequent submission to CDI. In the June 21 subsequent submission that was a response from Health Net to specific CDI request for more information, CDI objected to the unlimited maximum out-of-network out-of-pocket (MOOP) amount and the inclusion of higher out-of-network (OON) deductibles of the original rate filing.

CDI Objection #6, #7 & #8: OON MOOPs; PLATINUM AND GOLD PLANS OON Deductibles; BRONZE OON Deductibles

#6: In the 2016 plans, the OON MOOPs are double the in-network MOOPs. As you were previously advised, HNL may not eliminate the OON MOOP because this constitutes a change in cost sharing structure. 45 CFR 147.106(e)(3)(iv); Confidential Undertaking 5(a). Please restore the prior cost sharing structure such that the OON MOOPs in all the plans are double the in-network MOOPs.

#7: As you were previously advised, HNL may not add $5,000 individual/$10,000 family OON deductibles to the platinum and gold plans because increasing the OON deductibles from $0 to $5,000/$10,000 constitutes a change in cost sharing structure that would trigger a discontinuation. 45 CFR 147.106(e)(3)(iv); Confidential Undertaking 5(a).

#8: In 2016, the OON deductibles were double the in-network deductibles. HNL must continue to use that cost sharing structure. 45 CFR 147.106(e)(3)(iv); Confidential Undertaking 5(a). The required OON deductibles are: Individual $12,600; and Family $25,200.

Health Net adjusted these plan benefits in their July subsequent rate filing.

Proposal B Increase OON Cost Share Amounts – Deductible and MOOP

For PPO we propose to make the following benefit changes to Out-of-Network deductibles and Maximum Out of Pocket:

OON Deductibles:

- Platinum – $2,000/$4,000 (as we have already updated)

- Gold – $3,000/$6,000 (as we have already updated)

- Silver – No change

- Bronze – Reduce from $13,600/$27,200 to 2x in-network at $12,600/$25,200

- Minimum Coverage – No change

OON OOPMs (change from unlimited to 2x in-network):

- Platinum – $10,000/$20,000

- Gold – $13,500/$27,000

- Silver – $13,600/$27,200

- Bronze – $13,600/$27,200

- Minimum Coverage – $14,300/$28,600

The changes in deductible impact the single risk pool by -0.6%, though they vary by metal tier.

The changes in MOOP have a nonmaterial impact to the single risk pool, though there are 0%- 0.2% reductions in claims by PPO metal tier.

Note, this impacts only PPO plans, our EPO Plans (which are On-Exchange) are not impacted as they have no Out-of-Network benefits. Services such as Emergency Care are not subject to the change as they are always paid at the In-Network cost share.

New healthy consumers won’t offset increased costs

Health Net stated in their original rate filing that were hoping to find another $9.6 million in claims reduction. They don’t anticipate a wave of new healthy people entering the market place that would increase their revenue with an absence of medical claims.

2017 Initiatives

Note the rate increase of 23.0% assumes that we will be able to find $9.6 million in claims reductions initiatives on top of the Substance Abuse and OON Initiatives that we’ve already implemented and/or conceptualized. Without this assumption, we are operating at a profit loss of -1.9%, rather than a profit gain as shown in this filing.

(N) Morbidity adjustment – Healthy lives entering the market

We don’t expect healthy lives entering the risk pool to impact our population materially. Instead, we build this assumption into the risk adjustment estimate. Please see (AG) Risk Adjustment- Improvement due to Morbidity for a description of this adjustment.

The change of Health Net’s PPO plans to include a maximum out-of-network amount and lower out-of-network deductibles had the impact increasing the premiums for those off-exchange health plans.

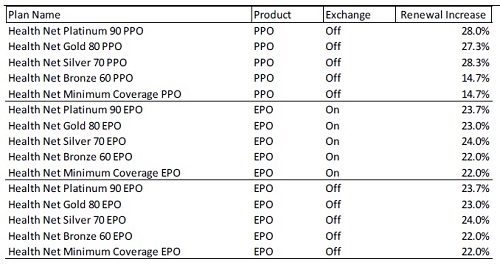

Health Net percentage rate increases of original rate filing

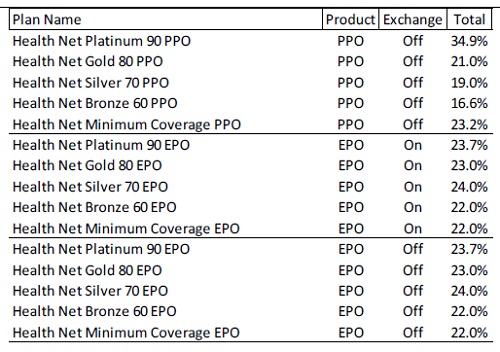

Health Net percentage rate increases after adjustment to plan benefits

California Department of Insurance still needs to approve the Health Net rate filing. You can leave comments about the proposed rates at https://interactive.web.insurance.ca.gov/apex/f?p=102:2:0::NO and navigating to the latest Health Net rate filing for their individual and family plans.

Original May 2, 2016 Rate Filing

HealthNetHAO20160086

Subsequent Submission with changes to plan benefits July 14, 2016

HAO20160086SubsequentSubmissionJuly142016

Response to CDI questions of original rate filing June 21, 2016

HAO20160086SubsequentSubmissionJune212016