The Covered California Board approved a resolution at their June 2014 meeting to allocate $16.9 million toward establishing a Navigator program. Under the new Navigator program organizations awarded grants will be encouraged to open store fronts, theyll receive bonuses for exceeding enrollment projections and theyll be allowed to advertise their services. Short of requiring an insurance license and carry the mandatory errors and omissions insurance, Covered California will be subsidizing non-profit organizations to directly compete against certified insurance agents.

Covered California to allow Navigators to solicit health insurance

Some of the key attributes for the Navigator program presented to the Board were-

-

Navigators will have flexibility in choosing subcontractors

-

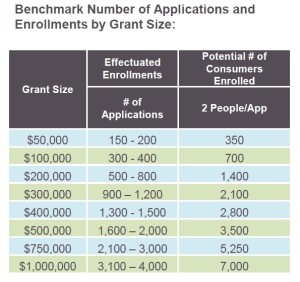

Grant proposals as small as $50,000

-

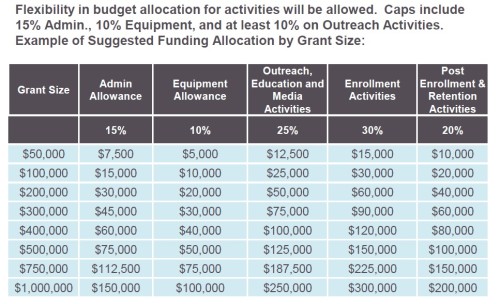

Allow up to 10% of grant to be spent on advertising

-

Establish a bonus pool for high enrollment performance

-

Encourage grant funds to be spent on store fronts

The budget allocation of $16.9 million is expected to be distributed in the following manner-

-

$14.65 million in grants to organizations with the expectation of reaching 100,700 new Covered Ca subsidy eligible consumers.

-

$2.25 million bonus pool for reaching an additional 30,000 consumers. For each 100 effectuated consumers (aka: successfully enroll and make their first premium payment) the organization will receive a $7,500 bonus payment.

Original Navigator program was scrapped

This revised Navigator program was developed after the first iteration of the Navigator plan didnt address many of the deficiencies of the existing Certified Enrollment Entity/Certified Enrollment Counselor model. The Covered California staff worked with numerous current Certified Enrollment Entities and other stakeholders to develop the new proposal brought before the Board in June. The tentative plan is to start awarding grants in October for the start of 2015 open enrollment on November 15th. Download the full presentation at the end of the post.

Public comment called for delay

There was significant public comment against the new Navigator program. While the comments, ranging from various interest groups to actual Certified Enrollment Entities (CEE), supported changes in the current system, many people expressed their desire for the Board to delay any decision and allow for more stakeholder input. Some of the issues raised were that smaller CEEs would not be able to receive a grant, bonuses put too much emphasis on production and that receiving the full amount of the grant was tied to effectuated applications.

No opposition from carriers to Navigators

On the last point that payment was dependenton effectuated or members actually making their first premium payment I say, Welcome to our world! An agent can work his or her bottom off to enroll a family, but if they dont pay the premium, the agent doesnt make a commission. It was interesting that while at leasttwo carriers were in the audience, Kaiser and Blue Shield, I dont recall them making any public comment about the Navigator program like they did about the following topic of qualifying event verification for special enrollment. I suppose the carriers are just as happy to have Covered California subsidize their marketingefforts as opposed to spending it on commissions to agents. For every household that a Navigator enrolls that’s one less set of individuals the carrier must pay an agent a commission.

So for this 2015 open enrollment season, look for a Covered California subsidized store front and advertising to compete against certified agents who must maintain a license, training and E&O insurance.