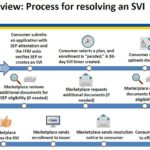

After a consumer has submitted an application under the Special Enrollment Period with a qualifying event, and then selects a health plan, the consumer will have 30 days to verify the qualifying event. The consumer can upload or mail the documentation verifying the qualifying event. The Marketplace will review the documentation and request additional information if necessary.

Notifying Dually-Enrolled Medicare and Healthcare.gov Consumers

Consumers who are identified as enrolled in MEC Medicare and a Marketplace plan through Medicare PDM should return to their Marketplace application and end their Marketplace coverage or Marketplace financial assistance. Consumers may have to pay back all or some of the APTC paid on their behalf for months they had both Marketplace coverage with APTC and MEC Medicare, when they file their federal income tax return.

Special Enrollment Verification for Healthcare.gov Phase 1

Beginning on June 23, 2017, consumers applying for health insurance through the Federally Facilitated Market Place (FFM) of Healthcare.gov will have to provide documentation to verify the qualifying life events of loss of coverage or a permanent move. In August, consumers with a qualifying life event of marriage, becoming a dependent, or Medicaid denial will also have to provide verification.

Incarceration status and health insurance subsidies

The Centers for Medicare and Medicaid Services has released a Frequently Ask Questions documents discussing health insurance subsidies when a person is incarcerated in jail or prison. This includes such situations of a person being arrested but not yet convicted of a crime and those on probation and parole.

Healthcare.gov tests health plan selection by doctor search function

Beginning today, HealthCare.gov is piloting a new beta feature that allows consumers to search plans by their preferred provider or health facility. Some consumers will be part of a pilot that allows them to use the beta Doctor Lookup feature as they compare their coverage options in window shopping or when selecting a plan.

Almost 1 million consumers use SEP to get health coverage in 2015

Between February 23 and June 30, 2015, about 944,000 new consumers made plan selections through HealthCare.gov using a SEP. Eighty-four percent of plan selections occurred via three types of SEPs: 50 percent of plan selections occurred via SEPs for the loss of health coverage or “minimum essential coverage”, 19 percent occurred via SEPs for being determined ineligible for Medicaid, and 15 percent were as a result of tax season SEP (Table 1). The remaining 16 percent of plan selections were attributable to other types of SEPs (see glossary).