Department of the Treasury Internal Revenue Service

Six Tips about Individual Shared Responsibility Payments

IRS Issue Number: HCTT 2016-12

For any month during the year that you or any of your family members don’t have minimum essential coverage and don’t qualify for a coverage exemption, you are required to make an individual shared responsibility payment when you file your tax return.

Here are six things to know about this payment:

- You are not required to make a payment if you had coverage or qualify for an exemption for each month of the year.

-

If you did not have coverage and your income was below the tax filing threshold for your filing status, you qualify for a coverage exemption and you should not make a payment.

-

If you are not a U.S. citizen or national, and are not lawfully present in the United States, you are exempt from the individual shared responsibility provision and do not need to make a payment. For this purpose, an immigrant with Deferred Action for Childhood Arrivals status is considered not lawfully present and therefore is exempt. You may qualify for this exemption even if you have a social security number.

-

If you are responsible for the individual shared responsibility payment, you should pay it with your tax return or in response to a letter from the IRS requesting payment. You should not make the payment directly to any individual or return preparer.

-

The amount due is reported on Form 1040 in the Other Taxes section, and in the corresponding sections of Form 1040A and 1040EZ. You only make a payment for the months you or your dependents did not have coverage or qualify for a coverage exemption.

In most cases, the shared responsibility payment reduces your refund. If you are not claiming a refund, the payment will increase the amount you owe on your tax return.

To learn more, visit the Reporting and Calculating the Payment page on IRS.gov/aca, or use our interactive tax assistant tool, Am I Eligible for a Coverage Exemption or Required to Make an Individual Shared Responsibility Payment?

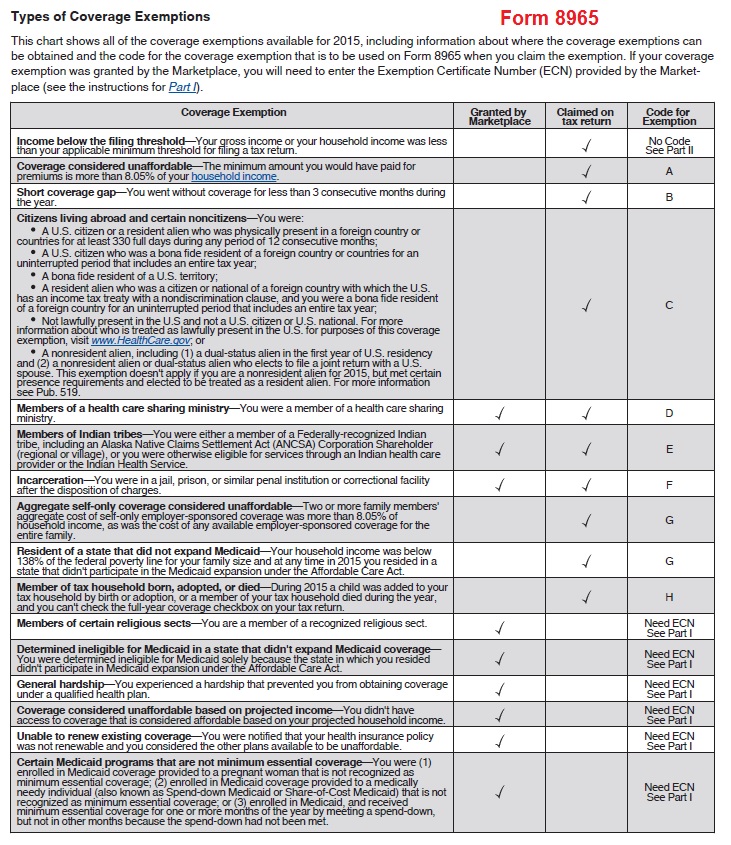

Types of Coverage Exemptions from the health insurance penalty or IRS Shared Responsibility Payment.