Healthcare.gov Individual and Family

Beginning on June 23, 2017, consumers applying for health insurance through the Federally Facilitated Market Place (FFM) of Healthcare.gov will have to provide documentation to verify the qualifying life events of loss of coverage or a permanent move. In August, consumers with a qualifying life event of marriage, becoming a dependent, or Medicaid denial will also have to provide verification.

To enroll in a health plan outside of open enrollment you must have a qualify event. If you have a qualifying event from the loss of coverage or a permanent move you will have to provide verification or proof of this event to the Healthcare.gov. Loss of coverage can occur because of a divorce or separation from a job and employer based health coverage. A permanent move can trigger a qualifying event when the new residency is outside the coverage area of your current health plan such as moving to a new state. (Some states manage their own Marketplace Exchange for health insurance and they may have different rules from Healthcare.gov.)

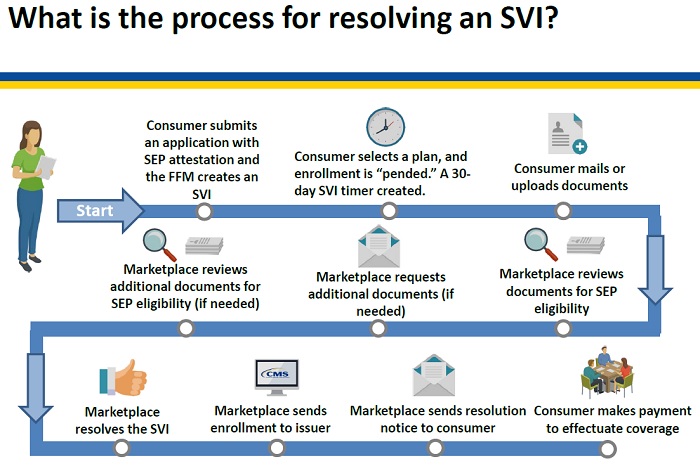

Healthcare.gov will start implementing pre-enrollment verification for the qualifying event of loss of coverage and permanent move beginning on June 23, 2017. The process will be called Special Enrollment Period Verification Issue (SVI). The consumer will be notified that they need to send the Marketplace documents to confirm they have the qualifying event stated on their enrollment application. The consumer will have 30 days to resolve their SVI once they select a health plan.

The consumer will not be enrolled in the health plan until the SVI is resolved. In other words, once the individual or family sends the necessary documentation to verify the qualifying event for the Special Enrollment Period, they will be enrolled in the health plan. In some cases, the effective date will be retroactive to when the consumer enrolled. The individual or family can start using the health plan once they pay their initial first month’s premium.

The SVI window is only 30 days. The consumer must get the documentation into the Marketplace within that window of time or lose their eligibility for the Special Enrollment Period. The documentation is crucial. You may have to call the Human Resources Department of the employer to get a letter generated that notes when coverage ended. Generally, Medicaid will send a notice of termination with the date.

The Special Enrollment Period lasts for 60 days after the date of the qualifying event. But once you start the enrollment process within that 60 day window, and the SVI is triggered, you only have 30 days to submit the verification documents.

A permanent move by itself is not a qualifying event. At least one of the household members had to have qualifying coverage for at least one of the 60 days preceding the date of the move or lived in a foreign country for at least one of the 60 days preceding the move. This condition does not apply to Alaska Native or American Indian members.

Some acceptable forms of verification of the qualifying event are

- Letter or bill from a consumer’s insurance company

- Letter from an employer

- Letter about COBRA coverage

- Letter from other health care program such as Medicaid, CHIP, TRICARE, VA, Peace Corp, or Medicare

- I-94 arrival record from foreign passport showing date of U.S. entry

More detail about Part 1 of the SEP Verification implementation can be found in the CMS document below, Overview: Special Enrollment Period Pre-Enrollment Verification (SEPV)