Covered California

Covered California has released guidance on reporting self-employment income. The 2016 Special Enrollment Quick Tips has not only income guidance for self-employed and season workers, but also information about qualifying events for the Special Enrollment Period outside of Open Enrollment and reconciling Advance Premium Tax Credits on the federal tax return.

From the Covered California 2016 Special Enrollment Quick Tips

How should self-employed or seasonal workers report their income?

Consumers that are self-employed or are seasonal employees may have difficulty accurately reporting their income as it can be subject to change or irregularity. If a consumer is unable to use their current monthly income to accurately determine what their annual income may be and they do not report changes to monthly income throughout the year, they may be required to reconcile APTC when filing taxes.

The consumer application has important features Certified Enrollment Reps should consider when assisting consumers in these scenarios:

- Consumers can edit their Total Expected Yearly Household income

- If the Total Expected Yearly Household Income displayed does not align with a consumer’s expectations, they can manually input their projected annual income. This will override their reported current monthly income and adjust their APTC eligibility accordingly.

- Job Aid: Income Pages

- Consumers can adjust the amount of APTC they receive monthly or choose to collect it at the end of the year

- If a consumer is not able to predict their annual income accurately and is concerned about reconciling APTC when filing taxes, they can choose to have all or part of their premium assistance sent directly to the insurance company monthly or to wait to receive the premium assistance as annual tax credit.

- Job Aid: Change Premium Assistance Amount

How does a consumer reconcile APTC with the actual premium tax credit on their return?

If a consumer’s actual allowable tax credit (based annual household income and family size) on their tax return is less than the advanced tax credit (APTC) they received during the coverage year the difference will be subtracted from the consumer’s refund or added to their balance due. The repayment amount is subject to limitations on additional taxes (see below). If the consumer’s actual allowable tax credit is more than the advanced tax credits they received during the coverage year, the difference will be added to their refund or subtracted from their balance due.

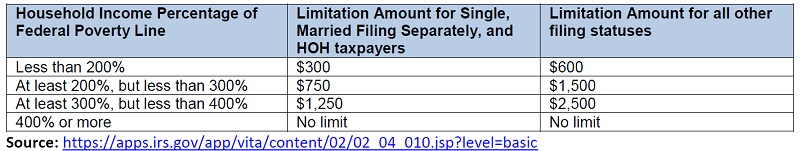

What are the limitations on additional taxes?

The IRS limits the amount of excess APTC a consumer must repay. The limits are based on a consumer’s household income and filing status. If the household income reported on their tax return is 400 percent of the FPL or higher, they must repay the full amount of APTC that exceeds their actual premium tax credit for which they were eligible.

When do consumers qualify for a Special Enrollment?

Outside of the Open Enrollment period, a consumer may be qualified for Special Enrollment for the following reasons:

- Lost or will soon lose my health insurance

- Permanently moved to/within California

- Had a baby or adopted a child

- Got married or entered into domestic partnership

- Returned from active duty military service

- Gained citizenship/lawful presence

- Member of a Federally Recognized American Indian or Alaska Native Tribe

Consumers do not need to be previously or currently enrolled in a Covered California plan to qualify.

Do you have a consumer that will be losing Minimum Essential Coverage (MEC) in the near future?

A consumer may be currently enrolled in coverage and aware of the date their coverage will expire. If they would like to proactively enroll with Covered California more than one month* in advance, contact a Covered California Service Center. For any applicant seeking coverage that is not more than one month in advance, Certified Enrollers may complete the application and select the “Loss of MEC” qualifying life event to get an expected coverage start date the following month.

*Consumers may report a Loss of MEC up to 60 days in advance

Do you have a consumer that needs to report a change in income?

Consumers should report any income increases or decreases during the coverage year, especially if the change in income is over 10%. Maintaining up to date income reporting will ensure that the consumer is receiving the appropriate amount of APTC (Advanced Premium Tax Credits) during the year and help avoid the need to reconcile (pay back) tax credits when filing taxes.

Reporting an Income Change during SEP:

- Access the consumers application to Report A Change

- Input the consumers updated income

- If there is no qualifying life event (example: Loss of MEC, Birth of A Child) for the consumer select “None of the Above”

- If the income change reported results in new APTC eligibility, or adjusts the amount of existing APTC, the consumer can move forward with plan selection

- The new plan will reflect the adjusted amount of APTC available to the consumer