Covered California

Covered California will be sending letters to their members who will be turning 65 years old informing them that they may no longer be eligible for the premium assistance because they will be Medicare eligible. If a consumer is offered minimum essential government health insurance, they are no longer eligible for the premium assistance offered through Covered California. For some consumers turning 65 years old and eligible for Medicare, the cost of the Part B premium and Part D prescription drug premium is more than they pay for health insurance through Covered California. If a Medicare Beneficiary adds a Medicare Supplement plan, the monthly cost can easily equal $225 to $300 per month.

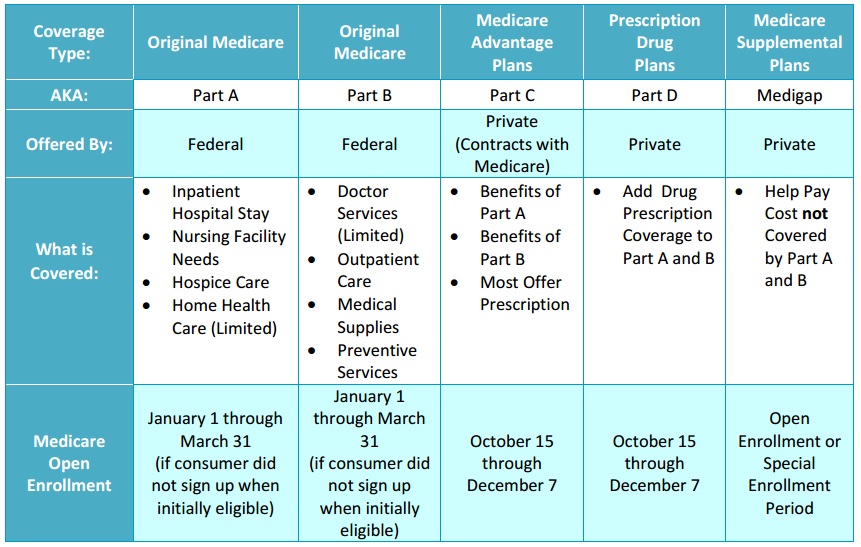

2016 Medicare Quick Guide

Beginning in August, 2016, Covered California will send a notice to those consumers approaching or are over their 65th birthday who may be eligible for Medicare. The notice advises them that they may no longer be eligible for Advanced Premium Tax Credit or Covered California coverage. If the consumer receives the notice, it will be displayed in the online application (CalHEERS).

Medicare

Medicare is the federal health insurance program for people who are 65 years of age or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).

Covered California Medicare benefits grid

Medicare and Covered California Eligibility

After becoming eligible for Medicare, most consumers will no longer qualify for financial assistance through Covered California and will need to cancel their Covered California plan. Consumers must report Medicare eligibility to Covered California within 30 days of becoming eligible. If these consumers continue to receive financial assistance, they may have to pay some or all of it back to the IRS at tax time. However, there is one exception:

- If the consumer has to pay a premium for Medicare Part A coverage and they have not enrolled in Medicare Part A, they may be able to continue Covered California coverage and keep their financial assistance.

Enrolling in Medicare

A consumer can apply for Medicare by calling the Social Security Administration during their Medicare Initial Enrollment Period, which starts three months before the month of their 65th birthday and ends three months after the month of your 65th birthday (total of seven months).

- If a consumer misses their Initial Enrollment Period, they can enroll during the General Enrollment Period from January 1 through March 31 of each year but they may have to pay a late enrollment penalty to Medicare, which may increase each year that they do not enroll in Medicare.

- If a consumer keeps their Covered California plan because they missed their Initial Enrollment Period, they may have to pay some or all of the financial assistance they received for their Covered California plan back to the IRS at tax time.

- Consumers cannot purchase a Covered California health plan while enrolled in Medicare. A Covered California health plan provides the same health benefits received on Medicare. However, consumers should still apply through Covered California because they may be eligible for additional coverage through Medi-Cal.

Terminating Covered California

- To avoid a gap in coverage, a consumer should not cancel their Covered California health plan until they know their Medicare coverage start date.

- A consumer’s enrollment in a Covered California plan will not be automatically be cancelled, even if they are enrolled in a Medicare plan through the same plan carrier as their Covered California health plan. The consumer must request the termination of the Covered California plan at least 14 days prior to their requested termination date.

- If a consumer does report Medicare eligibility to Covered California and continues to receive premium tax credits, they are deemed ineligible for premium tax credit as of the first day of the fourth calendar month following their 65th birthday.

- If a consumer’s Medicare coverage has already started, Covered California will not be able to cancel their coverage for past months or the current month.

Medi-Cal & Medicare Coverage

If a consumer qualifies for both Medi-Cal and Medicare, Medi-Cal will help pay for Medicare premiums and cost-sharing requirements, and may also cover some benefits that are not covered by Medicare, such as dental services, nursing home care, and personal care services. Also, a consumer might qualify for extra financial assistance to help with the cost of Medicare Part D prescription drug coverage.

Contact Information

- Medicare

- Questions on Medicare enrollment consequences

800.633.4227

- Health Insurance Counseling & Advocacy Program (HICAP)

- Free, individual counseling on Medicare coverage questions, rights, and health care options

800.434.0222

- Social Security Administration (SSA)

To change an address, Medicare Part A or Part B, or if a consumer lost their Medicare card

800.772.1213

Covered California Birthday Letter

You may now qualify for Medicare

Dear First Name Last Name,

Thank you for choosing health insurance through Covered California. Our records indicate that you or someone in your family may qualify for Medicare because you are, or will soon be, age 65 or older.

If you have a Covered California plan with financial assistance, you can keep it until you qualify for Medicare. But after becoming eligible for Medicare, most people will need to cancel their Covered California plan. This is because once you qualify for Medicare you will no longer qualify for financial assistance through Covered California and if you keep getting financial assistance, you may have to pay some or all of it back to the IRS at tax time.

Enrolling in Medicare

You can sign up for Medicare by calling the Social Security Administration during your Medicare Initial Enrollment Period, which starts three months before your 65th birthday and ends three months after your 65th birthday. If you miss your Initial Enrollment Period, you can enroll during the General Enrollment Period from January 1 through March 31 of each year but you may have to pay a late enrollment penalty to Medicare which may increase each year that you do not enroll in Medicare. If you keep your Covered California plan because you missed your Initial Enrollment Period, you may have to pay some or all of the financial assistance for your Covered California plan back to the IRS at tax time.

Canceling Covered California

To avoid a gap in coverage, do not cancel your Covered California health plan until you know your Medicare coverage start date. Your enrollment in a Covered California plan will not be automatically cancelled, even if you are enrolled in a Medicare plan through the same plan carrier as your Covered California health plan. You must contact the Covered California Service Center at 800-300-1506 and request to either cancel your plan (if you are the only member on your case) or report a change (if there are other family members in your Covered California plan).

It is best to call Covered California before your Medicare start date. If your Medicare coverage has already started, Covered California will not be able to cancel your coverage for past months. If you disagree with Covered California’s inability to cancel your coverage for past months, you have a right to file an appeal.

Remember, once you qualify for Medicare you will lose financial assistance for Covered California, even if you do not sign up for Medicare. There is only one exception: if you have to pay a premium for Medicare Part A coverage and you have not enrolled in it, you may be able to continue Covered California coverage instead and keep your financial assistance. Call Medicare for more information at 800-633-4227.

Getting Help and More Information

There are many ways to get more information or ask questions about Medicare and other health coverage:

- To cancel your Covered California plan or discuss your coverage options, call the Covered California Service Center at 800-300-1506.

- You can review and compare Medicare options at www.medicare.gov, call 800-MEDICARE, or work with a licensed insurance agent.

- For questions about changing your address, enrolling in Medicare Part A or Part B, or a lost Medicare card, call the Social Security Administration at 800-772-1213.

- You can contact the Health Insurance Counseling & Advocacy Program (HICAP) for free, individual counseling on Medicare coverage questions, rights, health care options, and low-income assistance options. Call 800-434-0222 to schedule an appointment with HICAP.

- You can also contact the Health Consumer Alliance for help at 888-804-3536.

You can also contact your health insurance agent that assisted you with your enrollment into Covered California.

Medicare_Notice_English_FINAL_Covered-California.pdf