Covered California has updated the CalHEERS income section of the individual and family plan application to accommodate partial year employment. This was accomplished with the insertion of simple date fields. Now, instead of the annualized income from a job a client has left, the employment can just have a start and end date.

Changes to income section for partial year employment

Thousands of Californians have wrestled with the CalHEERS program to report income from a seasonal job or one they were employed at for less than twelve months. The way the income section of the Covered California application was designed, the programmers seemed to assume that everyone had full-time jobs and never left them. The addition of a job inflated the income because the program assumed that it was for a full twelve months even if the individual started in August. The deletion of a job deflated the income because the wages received simply disappeared from the income summary.

Annualized income work around solution

The work around solution was to take either the past wages or the future wages and make it an annual payment so the CalHEERS program would add the income into the total while spreading out wages over twelve months. The simple solution to address a confusing income reporting system was to put a start and stop date to the employment into the program. Covered California finally did this in August of 2014. Of course, agents werent notified of this change to the program, we just have to trip over their systems updates.

Add Income

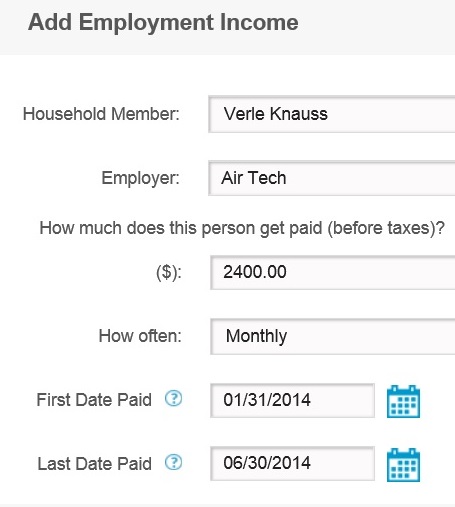

The simple date fields of First Date Paid and Last Date Paid have been added to the Income section. Now, if someone in the household leaves a job, the date of the last pay check can be entered without deleting the entry and converting it to an annual amount.

Future Income

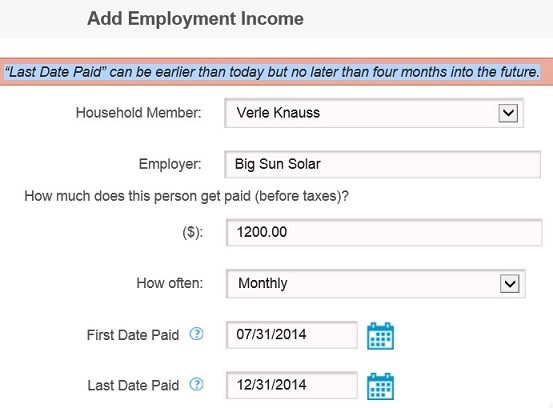

The CalHEERS program assumes that unless there is a Last Date Paid entered, the employment will be continuous for the rest of the year. You can only forecast three months in advance for future income. This might be problematic for people who have seasonal contracts that they know will have a date specific ending. They will have to re-enter the program and update the income when it ceases or changes.

Current Income

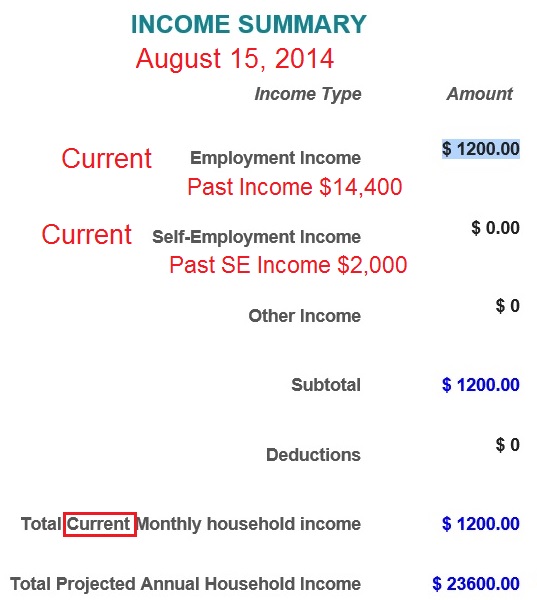

One confusing element of the new income summary page is that it only shows past income as part of the projected annual income. It isnt apparent that the current income multiplied by twelve does not equal the project income. Covered California should notate that this is taking place. The other concern is if the Advance Premium Tax Credit is being calculated from the current income or the projected annual income divided by 12 months. If the program is using the current income and the household had some large wage months prior to the income change, the family could be receiving too much tax credit for the Modified Adjusted Gross Income they will report on their federal taxes in 2015.