Covered California

Covered California will begin contacting employers of Covered California individuals and families notifying them that their employee is receiving Obamacare premium assistance. Only employers for whom enrolled Covered California members have provided employer contact information will be sent the notification. The letters will alert the employer that they may be subject to the employer shared responsibility payment if they have 50 or more employees.

Employers of Covered California members to get contacted

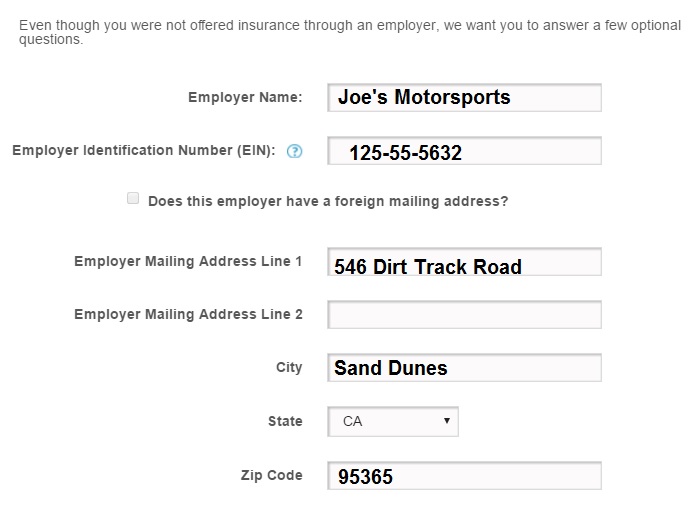

When individuals and families apply for health coverage through Covered California they are asked to provide information about their employer, even if the employer does not offer health insurance. This is an optional portion of application in most situations.

Covered California will begin sending letters to the employers of individuals and families who enrolled in Covered California health plans and are receiving premium assistance.

Employer Notice of Employee Coverage

Covered California will send a notice in August, 2016 to the employers of those consumers who provided contact information in the application. The notice is to inform employers that they may have employees who reported that their employer has not offered affordable, minimum standard valueⁱ coverage and that the employee has enrolled into a Covered California health plan (referred to in the notice as a Qualified Health Plan) and is receiving Advanced Premium Tax Credit (APTC).

Why is Covered California noticing Employers?

In the event that an employee of a large employer (50 or more employees) enrolls in health insurance via a federal or state exchange and receives APTC, the employer is being notified that they may be subject to the employer shared responsibilityⁱⁱ payment during tax time.

The Employer Shared Responsibility Provision of the ACA requires all large employers (over 50 employees) to provide affordable, minimum standard value coverage to their employee and dependents (definition of dependents does not include spouses).

What You Should Know

In the event that a consumer disagrees with their employer being notified:

1) Per the Affordable Care Act, employers with 50 or more employees have to be made aware of employees that sign up for coverage via an exchange and advised that this can result in a penalty via an employer shared responsibility payment.

2) The information that a consumer provides in Attachment C (paper application) or in the Personal Data section (online application) is attested to by the consumer via signature, or verbal agreement during the application process. The information has to be confirmed as it can have monetary consequences for their employer.

In the event that the employer disagrees with the information in the letter they receive:

1) Employers can appeal the determination that they did not provide affordable, minimum value coverage to their employees (and their dependents) in 2015 by filing an appeal with the U.S. Department of Health and Human Services (HHS) within 90 days of the date of the notice received. The HHS will then consider evidence provided by both employee and employer to determine the outcome.

- If it is also determined that employees (and dependents) were offered affordable, minimum value standard coverage by the Employer, then the employee will be subject to reconciliation of the APTC they received without penalization of the Employer.

Please Note: Filing an appeal does not necessarily absolve the employer from the Employer Shared Responsibility Payment to the IRS. This determination is reserved solely for the IRS.

Definitions

Employer-Sponsored Insurance (ESI) Affordability Standard

ESI is considered “affordable” if the employee’s contribution for self-only coverage does not exceed a specified percentage of the employee’s household income (9.66 percent in 2016). IRS updates this percentage annually.

ⁱMinimum Value Standard

Minimum value standard coverage is considered to provide “minimum value” if the plan covers at least, on average, 60 percent of an employee’s medical expenses (at least equivalent to a bronze plan).

ⁱⁱEmployer Shared Responsibility

The ACA’s employer mandate to provide health care is known as the “employer shared responsibility” provision. It is the monies paid to the IRS by an employer in the event that an employee is covered via an exchange with APTC and the employer didn’t offer a minimum standard coverage option for the employee and their dependents.

Affordability and Minimum Value Effect on Employee Eligibility for Covered California

If an employer does not provide a plan that meets the affordability limits and minimum value requirements, the employee can shop for insurance through Covered California and may qualify for APTC/CSR.

Resources:

- To learn more about the employer shared responsibility provisions, visit IRS.gov/aca. You can also contact the IRS at 1-800-829-4933, Monday – Friday, 7 a.m. – 4 p.m. The call is free.

- To access ‘Questions & Answers’ prepared by the Internal Revenue Service:

- For more information about the employer appeal process and to download the employer appeal request form, visit https://www.healthcare.gov/marketplace-appeals/employer-appeals/.

Employers can mail the completed form to:

Health Insurance Marketplace

Department of Health and Human Services

465 Industrial Blvd.

London, KY 40750-0061

Employer Notice

Employer Notice CCAN07 will be addressed to the Human Resources Department. It will list the all the employees who are receiving the Advance Premium Tax Credit (APTC) assistance through Covered California. It discusses how applicable large employers (50 or more full-time equivalent employees) are subject to the Employer Shared Responsibility provisions of the Affordable Care Act. If the applicable large employer does not offer affordable, minimum value health coverage to its full-time employees and their dependents, the employer may be subject to the Employer Shared Responsibility (ESR) payment that is assessed by the IRS. If at least one of its full-time employees receives APTC through Covered California or other Marketplace Exchange, then the employer could be subject to the ESR payment.

Employer-Notifiction-of-Employee-Coverage-Quick-Guide-FINAL.pdf