Centers for Medicare and Medicaid Services

August 13, 2015

2015 Special Enrollment Period Report – February 23 – June 30, 2015

The next open enrollment period for Marketplace coverage begins on November 1, 2015 for coverage starting on January 1, 2016. Some people can sign up for health coverage outside of open enrollment, before November 1, because they qualify for a special enrollment period (SEP). A consumer can qualify for a SEP for such circumstances as loss of health coverage, losing Medicaid eligibility, changes in family status (for example, marriage or birth of a child), or other exceptional circumstances.

This snapshot provides information about consumers who selected a plan between February 23 and June 30, 2015 through the HealthCare.gov platform, which includes 37 states with Federally Facilitated Marketplaces, State Partnership Marketplaces, and supported State-Based Marketplaces.

Nearly 950,000 new consumers selected a plan through the HealthCare.gov platform using a SEP between February 23 and June 30, 2015.

“Life changes are often impossible to predict, but access to affordable and quality health care coverage should never be. So far this year, nearly 950,000 people have gained the peace of mind that comes with access to coverage by taking advantage of a special enrollment period, providing us with further evidence that the Health Insurance Marketplace is working for America’s families,” said Kevin Counihan, CEO of the Health Insurance Marketplace. “We want people to know that if they lose a job, get married, have a baby, or experience other life changes, we’re here to help them find coverage they can afford.”

Today’s Special Enrollment Period Snapshot only reflects plan selection activity and, as such, does not capture whether consumers effectuated their enrollment and continued paying for health insurance coverage following the plan selection.

Overall SEP Activity

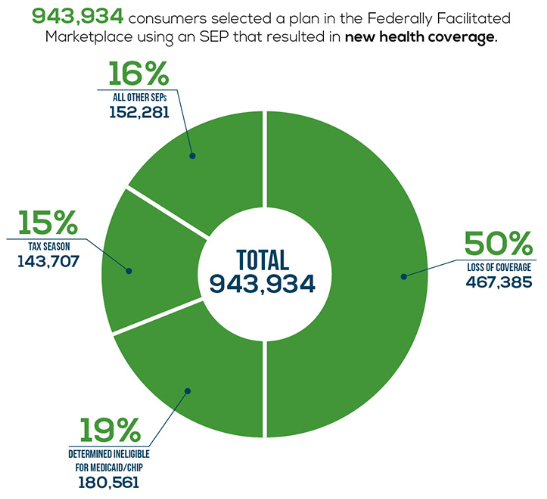

Between February 23 and June 30, 2015, about 944,000 new consumers made plan selections through HealthCare.gov using a SEP. Eighty-four percent of plan selections occurred via three types of SEPs: 50 percent of plan selections occurred via SEPs for the loss of health coverage or “minimum essential coverage”, 19 percent occurred via SEPs for being determined ineligible for Medicaid, and 15 percent were as a result of tax season SEP (Table 1). The remaining 16 percent of plan selections were attributable to other types of SEPs (see glossary).

Table 1: Plan Selections by Type of SEP – February 23 to June 30, 2015, HealthCare.gov States

| Type of SEP | Count | Percent |

| Loss of Coverage | 467,385 | 50% |

| Determined Ineligible for Medicaid/CHIP | 180,561 | 19% |

| Tax Season[1] | 143,707 | 15% |

| All Other SEPs | 152,281 | 16% |

| Total | 943,934 | 100% |

Figure 1: Plan Selections by Type of SEP – February 23 to June 30, 2015, HealthCare.gov States

When we examine SEPs by age, we find that SEP enrollees are younger than those who selected plans during the open enrollment period (Table 2). This suggests that the Health Insurance Marketplace is providing valuable continuity in coverage for younger consumers as they transition between jobs, move off their parent’s health insurance plan, or experience other life changes, such as getting married or the birth of a child.

943,934 consumers selected a plan in the Federally Facilitate Marketplace using an SEP that resulted in new health coverage.

Table 2: SEP Plan Selections versus Open Enrollment Plan Selections by Age, HealthCare.gov States

| Age Group | Open Enrollment Plan Selections | SEP Plan Selections | ||

| # | % | # | % | |

| 17 and under | 728,496 | 8% | 151,471 | 16% |

| 18-34 | 2,475,683 | 28% | 295,897 | 31% |

| 35-54 | 3,393,802 | 38% | 316,098 | 33% |

| 55+* | 2,240,310 | 25% | 180,468 | 19% |

| Total | 8,838,291 | 100% | 943,934 | 100% |

*Includes unknown age

SEP Activity Over Time

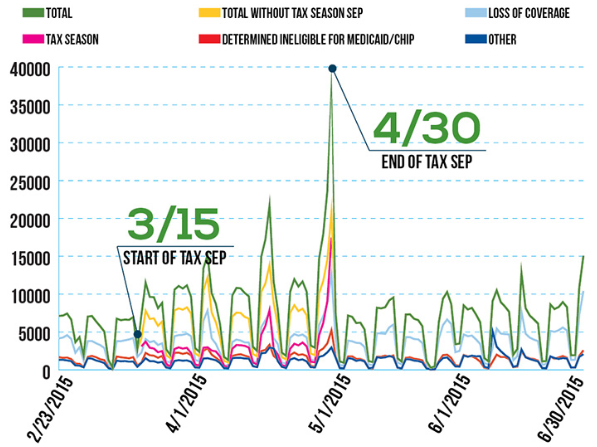

Figure 1 illustrates SEP activity over the February 23 – June 30, 2015 period. From February 23 to March 14, prior to the beginning of the tax season SEP, SEP plan selections averaged over 5,000 a day. With the beginning of the tax season SEP on March 15, there was a gradual increase in daily SEP activity, culminating in more than 38,000 plan selections on April 30, the final day of the tax season SEP. Of the 38,000 plan selections, more than 17,000 plan selections were due to the tax season SEP. Since the end of the tax season SEP, SEP activity averaged over 6,000 SEP plan selections per day between May 1 and June 30.

Figure 2: Daily SEP Plan Selections – February 23 to June 30, 2015, HealthCare.gov States

Graph shows the spike in enrollment from the End of Tax SEP in federally facilitated Marketplaces in 2015.

SEP Activity by State

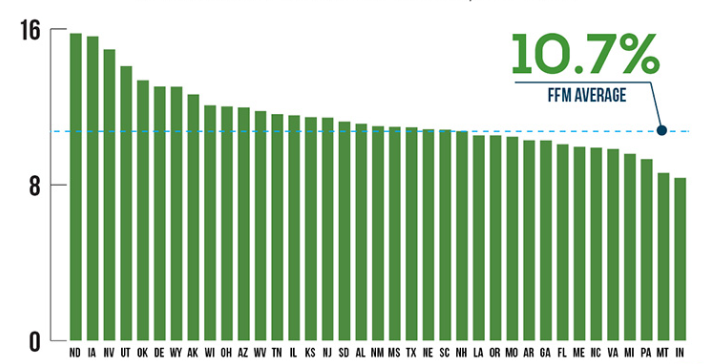

Figure 2 illustrates differences in SEP activity by state for the 37 states using HealthCare.gov. For this comparison, we calculated each state’s SEP plan selections between February 23 and June 30 as a proportion of their plan selections at the end of the open enrollment period for 2015 coverage on February 22. Across all states using the HealthCare.gov platform, SEP plan selections averaged 10.7 percent of total plan selections at the end of the open enrollment period. As Figure 3 illustrates, there were differences by state on this metric ranging from less than 9 percent in Montana and Indiana to more than 14 percent in Oklahoma, Utah, North Dakota, Nevada, and Iowa.

Figure 3: SEP Plan Selections as of June 30, 2015 as a Percentage of Plan Selections as of February 22, 2015, HealthCare.gov States

Bar graph shows the approximate percentage of uninsured Americans in each of the states with a federally facilitated Marketplace for 2015.

Table 3: SEP Plan Selections by State, February 23 – June 30, 2015, HealthCare.gov States

| State | Loss of Coverage | Denial of Medicaid | Tax Season | All Other SEPs | Total |

| AK | 1,010 | 523 | 436 | 720 | 2,689 |

| AL | 10,150 | 2,556 | 3,542 | 2,872 | 19,120 |

| AR | 3,500 | 1,379 | 860 | 1,023 | 6,762 |

| AZ | 11,860 | 5,770 | 2,734 | 4,236 | 24,600 |

| DE | 1,593 | 907 | 279 | 485 | 3,264 |

| FL | 78,611 | 24,188 | 30,064 | 27,965 | 160,828 |

| GA | 25,665 | 10,392 | 10,869 | 8,655 | 55,581 |

| IA | 3,478 | 1,989 | 618 | 958 | 7,043 |

| IL | 20,093 | 10,260 | 4,108 | 5,906 | 40,367 |

| IN | 9,097 | 4,681 | 1,995 | 2,555 | 18,328 |

| KS | 6,366 | 1,630 | 1,182 | 1,857 | 11,035 |

| LA | 10,265 | 2,117 | 4,359 | 2,883 | 19,624 |

| ME | 3,772 | 1,654 | 850 | 1,187 | 7,463 |

| MI | 16,358 | 7,976 | 3,703 | 4,584 | 32,621 |

| MO | 13,243 | 5,443 | 3,909 | 3,933 | 26,528 |

| MS | 5,276 | 1,833 | 2,932 | 1,425 | 11,466 |

| MT | 2,536 | 564 | 635 | 944 | 4,679 |

| NC | 27,230 | 8,510 | 10,187 | 9,591 | 55,518 |

| ND | 1,382 | 641 | 278 | 561 | 2,862 |

| NE | 4,005 | 1,846 | 945 | 1,251 | 8,047 |

| NH | 3,290 | 1,023 | 702 | 679 | 5,694 |

| NJ | 13,923 | 7,319 | 2,866 | 4,915 | 29,023 |

| NM | 2,422 | 1,949 | 458 | 929 | 5,758 |

| NV | 4,383 | 3,251 | 1,471 | 1,898 | 11,003 |

| OH | 15,992 | 5,701 | 2,747 | 3,682 | 28,122 |

| OK | 8,285 | 3,199 | 1,905 | 3,469 | 16,858 |

| OR | 7,224 | 1,258 | 1,481 | 1,852 | 11,815 |

| PA | 24,310 | 9,758 | 3,924 | 5,959 | 43,951 |

| SC | 11,398 | 3,070 | 4,782 | 3,549 | 22,799 |

| SD | 1,305 | 385 | 297 | 412 | 2,399 |

| TN | 15,171 | 3,350 | 4,422 | 4,003 | 26,946 |

| TX | 59,384 | 25,359 | 24,396 | 22,618 | 131,757 |

| UT | 8,321 | 5,991 | 1,868 | 3,615 | 19,795 |

| VA | 19,512 | 6,649 | 5,031 | 6,696 | 37,888 |

| WI | 13,394 | 6,108 | 2,161 | 3,356 | 25,019 |

| WV | 2,110 | 936 | 397 | 491 | 3,934 |

| WY | 1,471 | 396 | 314 | 567 | 2,748 |

| Total | 467,385 | 180,561 | 143,707 | 152,281 | 943,934 |

Conclusion

This preliminary analysis of SEP plan selections shows that there is healthy demand for health insurance coverage among individuals and families who experience a change in circumstance or qualifying life event throughout the year. SEPs are helping consumers avoid gaps in health insurance coverage by providing a valuable link to affordable health insurance options.

Glossary

Marketplace special enrollment periods are times that allow consumers to enroll in health coverage outside of the Marketplace Open Enrollment Period, or during Open Enrollment with an earlier coverage effective date, when certain events happen. In many cases, these events involve a change in family status (for example, birth of a child or marriage), but others may be related to issues like a loss of other health coverage. Special enrollment periods generally last for 60 days from the date of the qualifying event, although certain situations (like loss of coverage) may allow consumer’s access to a special enrollment period prior to the event, to avoid a gap in coverage. Below are the different situations in which HealthCare.gov consumers may qualify for a special enrollment period.

- Lose other health coverage: you or your family lose coverage that qualifies as minimum essential coverage (MEC) during the benefit year, including, but not limited to, most employer-sponsored coverage and Medicaid. If you or your family are enrolled in individual coverage or group health plan coverage that ended during the year or you lose Medicaid pregnancy-related coverage or Medicaid coverage for medically-needy, you may also qualify for this special enrollment period.

- Gain or become a dependent: you gain or become a dependent through marriage, birth, adoption, placement for adoption, placement in foster care, or due to a child support or other court order.

- Gain citizenship, national, or lawfully present status: you gain status as a citizen, national, or lawfully present individual.

- Experience a Marketplace enrollment error: you weren’t enrolled in a plan or were enrolled in the wrong plan because of misinformation, misrepresentation, misconduct, or inaction of someone working in an official capacity to help you enroll.

- Being determined ineligible for Medicaid/CHIP: you applied for Medicaid/the Children’s Health Insurance Program coverage during the Marketplace Open Enrollment Period or after qualifying for a special enrollment period and your state Medicaid/CHIP agency determined you weren’t eligible.

- Experience a plan contract violation: you adequately demonstrate to the Marketplace that your Marketplace health plan has substantially violated a material provision of its contract.

- Become newly eligible or ineligible for help paying for your coverage: you or your family are enrolled in coverage and are determined newly eligible or ineligible for advance payments of the premium tax credit (APTC) or have a change in eligibility for cost-sharing reductions (CSRs).

- Experience changes to employer-sponsored coverage and become newly eligible for help paying for your coverage: you’re now eligible for advance payments of the premium tax credit (APTC) because you’re no longer eligible for employer-sponsored coverage, your coverage is discontinued, or your coverage is no longer considered minimum essential coverage (MEC).

- Live in a state that hasn’t expanded Medicaid and become newly eligible for help paying for your coverage: you live in a state that hasn’t expanded Medicaid and you weren’t eligible for Medicaid or advance payments of the premium tax credit (APTC) when you first applied because your income was too low, but due to a change in household income, you’re now eligible for APTC.

- Gain access to new health plans because of a permanent move: you permanently move to a new area and have new Marketplace health plan choices.

- Gain or maintain status as an American Indian or Alaska Native: you gain or maintain status as a member of a federally recognized tribe or Alaska Native Claims Settlement Act (ANCSA) Corporation shareholders.

- Experience an exceptional circumstance: you demonstrate to the Marketplace that you’ve experienced an exceptional circumstance that prevented you from enrolling in coverage, like a serious medical condition or natural disaster.

- Experience domestic abuse/violence or spousal abandonment: you’re a victim or survivor of domestic abuse/violence or spousal abandonment and want to enroll in your own health plan separate from your abuser or abandoner.NOTE: This list of special enrollment periods doesn’t include time-limited special enrollment periods, including but not limited to those previously provided during tax season. If you think you’re eligible for a special enrollment period, visit HealthCare.gov or contact the Marketplace call center at 1-800-318-2596.

###

- [1] In May CMS reported that we had 147,000 plan selections using the Tax SEP between March 15 and April 30. Since that time, approximately 3,000 consumers have returned to the Marketplace to select a plan using a different SEP reason code. This analysis only reflects a consumer’s most recent SEP reason code.

Contact: CMS Media Relations