California Medi-Cal

On March 3, 2017, Department of Health Care Services sent a letter to all County Medi-Cal administrators informing them of the new 2017 federal poverty levels. The new federal poverty levels went up approximately 2%. This means that individuals applying to Covered California will have to have a higher income if they want the Advance Premium Tax Credits subsidy. The single adult annual income amount to qualify for the Covered California subsidy is now $16,644. It was $16, 395 in 2016.

For the 2018 Monthly and Annual Medi-Cal Income Chart please visit https://insuremekevin.com/2018-medi-cal-monthly-income-eligibility-chart/

Higher Federal Poverty Level Incomes for Medi-Cal

The letter sent to county Medi-Cal offices indicates that individuals who had been denied Medi-Cal on or after January 1st, will be re-evaluated for eligibility because the federal poverty levels took effect at the beginning of the year.

DHCS Letter Number 17-10

SUBJECT: 2017 Federal Poverty Levels

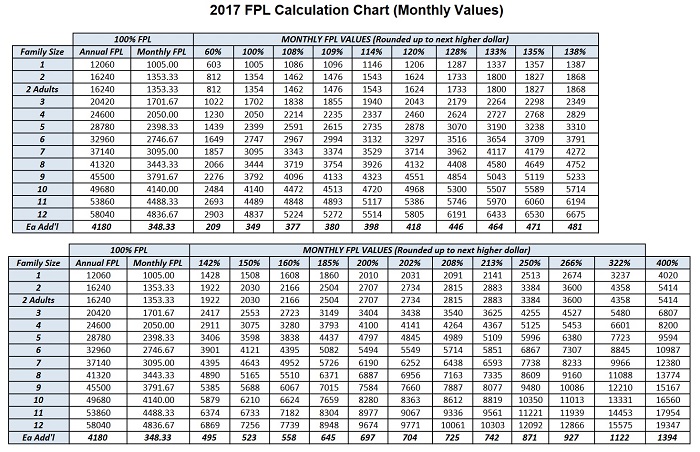

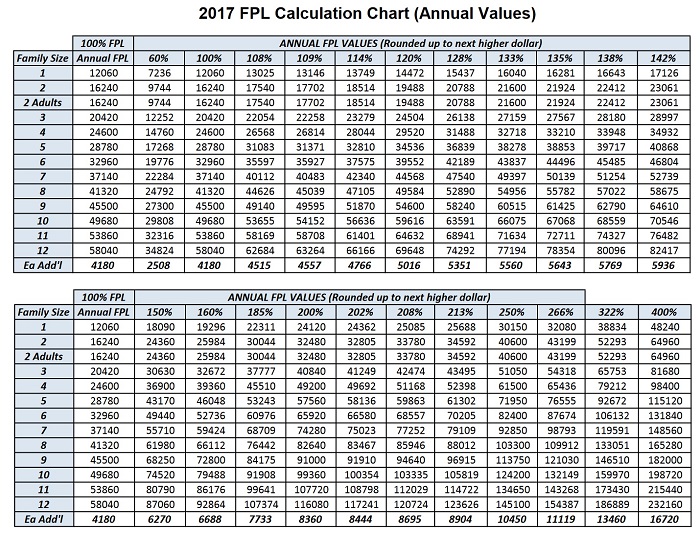

The enclosed charts provide the 2017 poverty level ceilings for Medi-Cal, Medi-Cal Access Program (MCAP), MCAP-Linked Infants, and County Children’s Health Initiative Program (C-CHIP). The C-CHIP is available in San Francisco, Santa Clara and San Mateo counties only. The Department of Health Care Services (DHCS) derives these ceilings from the annual Federal Poverty Level (FPL) figures published in the Federal Register on January 31, 2017. In this All County Welfare Directors Letter (ACWDL), DHCS is providing 2017 monthly FPL values (enclosure 1) as well as 2017 annual FPL values (enclosure 2).

Counties must review all denials and discontinuances for the following groups back to the date specified in the attached chart, and reevaluate eligibility based on the revised FPL figures as of the effective dates specified below.

For applicants and beneficiaries who are parent/caretaker relatives, children, pregnant women, and non-Medicare recipients who are age 19 up to 65 whose eligibility is determined based upon Modified Adjusted Gross Income methodologies, the new FPLs are effective January 1, 2017, due to whole month eligibility.

Please note: Due to delays in implementing these FPLs in the California Healthcare Eligibility Enrollment and Retention System (CalHEERS), DHCS initiated a Change Request for the CalHEERS system to update automatically the annual FPL amounts. DHCS will send a notice to the beneficiaries potentially impacted by the change to inform them of the FPL increase and the option to request a redetermination. DHCS will not reimburse beneficiaries for premiums paid, according to guidance from the Centers for Medicare and Medicaid Services. The notice will state that no premium reimbursements will be available. Therefore, counties shall retroactively change eligibility only for those Optional Targeted Low-Income Children’s Program eligible children, Advance Premium Tax Credit eligible individuals who did not enroll in a plan or did not pay a premium, and individuals who are eligible only for the Medi-Cal programs with a Share-of-Cost in the same month. Finally, counties shall move pregnant women eligible in aid code M9 on or after January 1, 2017, to aid code M7 as of the date of implementation of these FPLs, to ensure continuity of care in accordance with ACWDL 15-35.

For applicants and recipients of the Medicare Savings Programs (MSP), Qualified Medicare Beneficiary, Specified Low-Income Medicare Beneficiary and Qualified Individual 1 who do not receive Title II Retirement Survivors and Disability Insurance (RSDI) income, counties must apply the new FPL figures retroactively to January 1, 2017.

For MSP applicants or recipients who are receiving Title II RSDI income, the effective date for the new FPLs is March 1, 2017.

For individuals who are eligible for the Aged, Blind and Disabled FPL programs, the effective date of the revised FPL figures is April 1, 2017.

2017 FPL Calculation Chart (Monthly Values) Program Percentages

$35: = Maintenance Need for Resident in LTC Facility

100% FPL:

= Qualified Medicare Beneficiary (QMB) Program; and

= Children Ages 6 Up to 19 Percent Program (Pre ACA); and = FPL Program for Aged and Disabled; and

= Section 1931 for certain Recipient’s (Pre ACA)

108% FPL: = Floor ACA Title XXI CHIP Expansion Children Ages 6-19

109% FPL:

= ACA Parents and Caretaker Relatives 114% FPL:

= ACA Parents and Caretaker Relatives not eligible for the ACA New Adult Group due to non-financial eligibility criteria such asenrollment in Medicare Parts A or B (109% FPL, plus 5% MAGI disregard)

120% FPL: < Specified Low-Income Medicare Beneficiaries (SLMB)

128% FPL: = Disabled Individuals in New Adult Group *ACWDL will be released when implemented

133% FPL:

= Children Ages 1-6 (Pre ACA)

= ACA Children and Title XXI Expansion Children Ages 6-19

135% FPL: < Qualified Individual 1 Program (QI-1)

138% FPL: = ACA New Adults Ages 19-64

138% FPL and below: = Full Scope Coverage for ACA Pregnant Women Above

138% – 213% FPL: = Pregnancy Related Medi-Cal Above

213% – 322% FPL: = Medi-Cal Access Program (MCAP)

142% FPL: = ACA Children Ages 1-6

150% FPL: = Target Low Income Program (Pre ACA)

160% FPL: = ACA OTLIC Program

185% FPL: = Transitional Medi-Cal (TMC) (Pre ACA)

200% FPL:

= Qualified Working Disabled Individuals; and

= Pregnant Women and Infants Up to Age 1 (disregard is in the 200% FPL) (Pre ACA)

= Refugee Medical Assistance (RMA)

202% FPL: = Transitional Medi-Cal (TMC) (Post ACA) *ACWDL will be released when implemented

208% FPL: = ACA Infants Ages 0-1

213% FPL: > Floor for ACA MCAP Linked Infants (OTLIC)

= ACA Pregnant Women and Infants Up To Age 1 (with 5% earned income disregard included)

250% FPL: = Optional Targeted Low Income Children (Pre ACA), and for Working Disabled Program

266% FPL:

= ACA Optional Targeted Low Income Children (OTLIC)

Above 266%-322% FPL: = County Childrens Health Initiative Pro

322% FPL: = ACA MCAP Linked Infants

Notes:

“=” means: eligible if budget unit income is equal to or less than income limit

“<” means: eligible if budget unit income is less than income limit

“>” means: eligible if budget unit income is greater than income limit

For applicants and recipients of the Medicare Savings Programs (MSPincludes Qualified Medicare Beneficiary, Specified Low Income Beneficiary and Qualified Individual 1 Programs) not receiving RSDI Title II income, the FPL figures are effective January 1, 2017, beginning the month of publication for MSP applicants or recipients receiving RSDI Title II income, the new FPL figures are effective March 1, 2017.