IRS Forms 1095 – A, B, and C Quick Guide

IRS Forms 1095 – A, B, and C Quick Guide

The Affordable Care Act (ACA) requires IRS Forms 1095 – A, B, and C be provided to consumers and a copy to the IRS. Below is an overview of each form, which comes with a letter of explanation, tax reporting directions, and contact information for the appropriate follow-up.

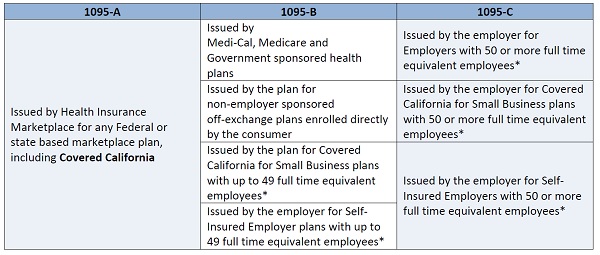

Refer to the below table to quickly understand what you need to know about each form:

*Consumers should check with their employer to determine employer size based on the number of full-time equivalent employees

Refer to Form 1095 A, B, and C sections below for a quick overview and more information about each version of the form:

Form 1095-A

- Any federal or state-based marketplace plan, including Covered California is to supply the IRS Form 1095-A

- A Form 1095-A is generated for each plan enrollment, and for all months an enrolled member had coverage, regardless if Advanced Premium Tax Credit (APTC) was applied

- The amounts displayed on a 1095-A reflect how much was paid to Covered California Health Insurance Companies to help with the cost of a consumer’s health coverage

- A 1095-A Form helps ensure the amount of APTC applied in 2015 is accurately reported and serves as proof of Minimum Essential Coverage (MEC)

- Covered California members who enrolled in a minimum coverage plan, also known as catastrophic coverage, will not receive a Form 1095-A, but instead a Form 1095-B or 1095-C directly from their health insurance company

- A Covered California member may also receive a 1095-B or 1095-C, continue reading below to understand if members of your household may receive a different version of the form

- Households with a Covered California Plan and Medi-Cal enrollment will receive both a 1095-A and 1095-B

- For questions about the Form 1095-A or requested corrections to the form, refer to the Dispute Form and Dispute Process Information found on CoveredCA.com

Form 1095-B

- The following are to supply an IRS Form 1095-B:

o Government-sponsored healthcare programs and plans (e.g. Medi-Cal, Medicare, Tricare, etc.)

o Healthcare plans administered by Covered California for Small Business (CCSB) with up to 49 full-time equivalent employees

o Self-insured employers with up to 49 full-time equivalent employees

o Non-employer sponsored off-exchange healthcare plans

- Form 1095-B will reflect all months an enrolled member had coverage

- Consumers who receive Form 1095-B may use it as proof of MEC

- For questions about the Form 1095-B or requested corrections to the form, consumers should contact the plan or corresponding state or government entity

o Medi-Cal 1095-B Help Desk

1-844-253-0883

For TTY call 1-844-357-5709

Form 1095-C

- The following are to supply an IRS Form 1095-C:

o Applicable Large Employers (ALE) with 50 or more full-time equivalent employees

o ALEs administered through CCSB with 50 or more full-time equivalent employees

o Self-insured ALEs with 50 or more full-time equivalent employees

- 1095-C reports all months of employer-sponsored MEC offered to the employee, spouse and/or dependents

- Consumers who receive Form 1095-C may use it as proof of MEC

- For questions about the Form 1095-C or requested corrections to the form, consumer should contact their employer

IRS Issue Number: HCTT 2016-36

Keep your Health Insurance Documents with Your Tax Records

Gathering documents and keeping well-organized records make it easier to prepare a tax return. They can also help provide answers if the IRS needs to follow-up with you for more information.

This year marks the first time that you may receive information forms about health insurance coverage.

The information forms are:

- Form 1095-A, Health Insurance Marketplace Statement

- Form 1095-B, Health Coverage

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage

You do not need to send these forms to IRS as proof of your health coverage. However, you should keep any documentation with your other tax records. This includes records of your family’s employer-provided coverage, premiums paid, and type of coverage. You should keep these – as you do other tax records – generally for three years after you file your tax return.

When preparing 2015 tax returns, most people will simply have to check a box to indicate they and everyone on their tax return had health care coverage for the entire year. You will not need to file any additional forms, unless you are claiming the premium tax credit or a coverage exemption. In which case, you will use Form 8962, Premium Tax Credit, or Form 8965, Health Coverage Exemptions.

For more information about the information forms, see our Questions and Answers on IRS.gov/aca.

IRS Issue Number: Revised HCTT-2016-32

Six Things to Know about the Employer Shared Responsibility Provisions

The health care law includes the employer shared responsibility provisions, which require applicable large employers to offer health coverage to full-time employees and their dependents. Those that do not offer coverage might be subject to the employer shared responsibility payment.

Here are six facts about these provisions.

1. These provisions apply to applicable large employers, which includes tax-exempt and federal, state, local and Indian tribal government employers. You’re an applicable large employer if you have 50 or more full-time employees, including full-time equivalents.

2. If you have fewer than 50 full-time employees, including full-time equivalents, you are not an applicable large employer and are generally not subject to these provisions. However, you are subject to the rules for large employers if you have fewer than 50 employees, but are a member of an ownership group that has 50 or more full-time equivalent employees,

3. Under certain conditions relating to the employer’s maintenance of workforce and pre-existing health coverage, an employer won’t be assessed a payment for 2015. This transition relief is available for tax year 2015 for certain ALEs who have fewer than 100 full-time employees, including full-time equivalents. .

4. You are subject to the payment if at least one full-time employee receives the premium tax credit and any one of these conditions apply. Your organization:

- failed to offer coverage to full-time employees and their dependents

- offered coverage that was not affordable

- offered coverage that did not provide a minimum level of coverage

5. You do not report or include an employer shared responsibility payment with any information return you file.

6. The IRS will contact you about your potential shared responsibility payment amount. You’ll have an opportunity to respond before the IRS assesses any liability or issues a notice and demand for payment.